Community Empowerment by Dr. SBM Prasanna, Dr. K Puttaraju, Dr.MS Mahadevaswamy (best fiction novels to read .txt) 📖

Book online «Community Empowerment by Dr. SBM Prasanna, Dr. K Puttaraju, Dr.MS Mahadevaswamy (best fiction novels to read .txt) 📖». Author Dr. SBM Prasanna, Dr. K Puttaraju, Dr.MS Mahadevaswamy

Key word: Priority Sector, Weaker Section, Financial Inclusion, Nonperforming Assets.

INTRODUCTION:

The term ‘priority sector’ indicates those activities which have national importance and have been assigned priority for development. Hence, the adoption of priority sector concept for the purpose of bank lending reflects the effort to synchronize the lending activities of each bank with the national priorities. These sectors, in particular agriculture, small industries and other small business were the neglected sectors and for the purpose of bank credit, they have been categorized as priority sector.

Financial inclusion is the delivery of banking services to all the sections of the society at an affordable cost. Easy access to public goods and services is the sine qua non of an open and efficient society. As banking services are in the nature of public good, it is essential that availability of banking and payment services to the entire population without discrimination is the prime objective of the public policy

BASIC CONCEPT OF FINANCIAL INCLUSION IN INDIA:

Accordingly Asian Development Bank (2000): inclusion as the provision of a broad range of financial services such as deposits, loans, payment services, money transfers and insurance to the poor and low income households and their micro–enterprises. The World Bank (2008) states: Financial inclusion as the broad access to financial services implying an absence of price and non-price barriers in the use of financial services; it is difficult to define and measure access because access has many dimensions.

The United Nations (2006) notes: Financial sector that provides access to credit for all bankable people and firms, to insurance for all insurable people and firms and to savings and payments services for everyone. Inclusive finance does not require that everyone who is eligible to use each of the services, but they should be able to choose to use them if desired. The Committee on Financial Inclusion in India (2008) indicates: Financial inclusion implies the process of ensuring access to financial services and timely and adequate credit. Where needed by vulnerable groups such as weaker sections and low income groups at an affordable cost

POLICY MEASURES OF RBI

The description of the priority sector was formalized in 1972 on the basis of the report submitted by the informal study group on statistics relating to advances to the priority sector, constituted by the Reserve Bank. Although, initially, there were no specific targets fixed in respect of priority sector lending in November, 1974. Public sector banks were advised that their priority sector lending should reach a level of not less than one-third of the outstanding credit by March 1979. In November 1978 the private sector banks were also advised to send a minimum of thirty three Percent of their total advances to the priority sector by the end of March 1980. Subsequently, the target was enhanced to forty Percent of aggregate advances. In achieving this overall target, sub-target for lending to agriculture sector and weaker section were also stipulated for the banks.

Foreign banks operating in India were also advised to progressively increase their advances to the priority sector to reach a level of fifteen percent of their NBC by end-March 1992. In April 1993, this ratio was further raise to thirty two percent of NBC to be achieved by March 1994. Within the enhanced target of thirty two percent, two sub-targets of ten percent in respect of small scale industries and twelve percent for export were fixed. On the basis of revised guidelines on lending to the priority sector, the priority sector lending sub-target have been linked to Adjusted Net Bank Credit Priority sectors and financial inclusions of off-balance sheet exposures, whichever is higher, with effect from 30 April 2007.

OBJECTIVES:

The major objectives of the study

To study the role of priority sector lending of banks on financial inclusion in India.

To analysis the impact of priority sector lending of banks on financial inclusion in India

HYPOTHESES:

The following hypotheses will be framed to meet the objective of the study.

Priority sector lending of banks on financial inclusion are not significant in India.

Priority sector lending of banks increases more Non Performing Assets.

METHODOLOGY:

In this paper we are used in the Secondary data. Secondary data has been collected from the published sources such as various periodicals, articles, journals, reports, literatures and books on the issue. For the point of gathering the newest up–dated information on the topic E–sources also consulted.

THE SCOPE OF FINANCIAL INCLUSION:

In India the focus of the financial inclusion at present is confined to ensuring a bare minimum access to a savings bank account without frills, to all. Internationally, the financial exclusion has been viewed in a much wider perspective. Having a current account / savings account on its own, is not regarded as an accurate indicator of financial inclusion. There could be multiple levels of financial inclusion and exclusion. At one extreme, it is possible to identify the ‘super-included’, i.e., those customers who are actively and persistently courted by the financial services industry, and who have at their disposal a wide range of financial services and products. At the other extreme, we may have the financially excluded, who are denied access to even the most basic of financial products. In between are those who use the banking services only for deposits and withdrawals of money. But these persons may have only restricted access to the financial system, and may not enjoy the flexibility of access offered to more affluent customers.

INDIAN SCENARIO:

Bank nationalization in India marked a paradigm shift in the focus of banking as it was intended to shift the focus from class banking to mass banking. The rationale for creating Regional Rural Banks was also to take the banking services to poor people. The branches of commercial banks and the RRBs have increased from 8321 in the year 1969 to 68,282 branches as at the end of March 2005. The average population per branch office has decreased from 64,000 to 16,000 during the same period. However, there are certain under-banked states such as Bihar, Orissa, Rajasthan, Uttar Pradesh, Chhattisgarh, Jharkhand, West Bengal and a large number of North-Eastern states, where the average population per branch office continues to be quite high compared to the national average. As you would be aware, the new branch authorization policy of Reserve Bank encourages banks to open branches in these under banked states and the under banked areas in other states. The new policy also places a lot of emphasis on the efforts made by the Bank to achieve, inter alia, financial inclusion and other policy objectives.

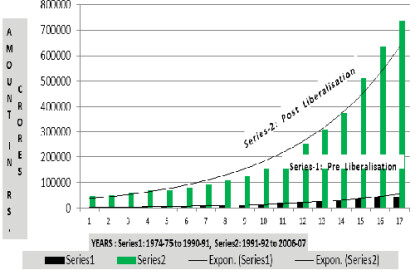

Priority Sector Lending Of Banks in India-Pre and Post-Liberalization

Source: Bank and Bank systems volume 5

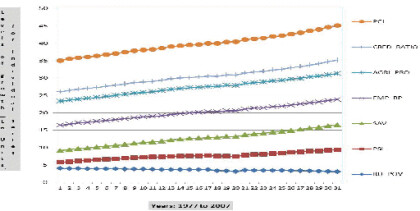

Trend’s of Inclusive Growth in India

Source: Bank and Bank systems volume 5

CATEGORIES OF PRIORITY SECTOR ADVANCES:

Agricultural Finance

Small scale industries Finance

Finance of Small business and service enterprises

Micro credit

Education loans

Housing loans

ROLE PRIORITY SECTOR LENDING ON FINANCIAL INCLUSION

It helps to small and marginal farmers through agriculture finance including subsidies, insurance, green card, kissan card and other financial services

It promotes small and cottage industries to the SMEs finance through bank accounts, cheque, subsidies and other financial services

It encourages to SHGs through micro finance like group loans, individual loans etc…

It provides home loans through cheques, debit cards

It gives education loan through bank accounts

It helps small businesses through bank account including subsidies

FINDINGS:

Priority sector lending are increases transaction cost of the banks.

Priority sector lending and financial inclusion are low profitability in banking sector.

Priority sectors lending of banks are facing some quantitative targets.

Another one of the major problem of bank is that government interferes in the public sector banks.

Sanctioning and monitoring of large number of small advances is time consuming.

SUGGESTIONS

Debit recovery tribunal should implement of banks.

Bank should is very careful in considering settlement compromise proposal.

Bank should try to introduce a system of internal audit section.

Bank should follow the guidelines of RBI for the rate of interest.

Bank should in the respect of direct agricultural advances.

Bank should be not compound the interest in the case of current dues.

A hugely expanded bank branch and cooperative network like RRBs;

A grater focuses on credit rather then other financial services like savings and insurance, deposit facilities.

Lending targets directed at a range of priority sector such as agriculture, weaker section of the population.

Significant government subsidies channeled through the banks and government programmers.

CONCLUSION

Financial inclusion has far reaching consequences, which can help many people come out of abject poverty conditions. Financial inclusion provides formal identity, access to payments system and deposit insurance. There is a need for coordinated action between the banks, the government and others to facilitate access to bank accounts amongst the financially excluded.

To sum up, banks need to redesign their business strategies to incorporate specific plans to promote financial inclusion of low income group treating it both a business opportunity as well as a corporate social responsibility. They have to make use of all available resources including technology and expertise available with them as well as the MFIs and NGOs. It may appear in the first instance that taking banking to the sections constituting “the bottom of the pyramid”, may not be profitable but it should always be remembered that even the relatively low margins on high volumes can be a very profitable proposition. Financial inclusion can emerge as commercial profitable business. Only the banks should be prepared to think outside the box!

REFERENCE:

Banks and Bank Systems Volume 5, issue 4.2010

World Bank indicators of Financial Access household. Level Surveys. (2005)

Gupta .S and Kumar .S., “Dimensions and Prospects of Nonperforming Assets Challenges Before the Banking Sector Reform in the New Millennium”, Edited Book Banking in the New Millennium, (2004); PP: 279–291.

Ahmed J. U., “Bank Financing of Small Scale Industries”, – A Diagnostic Evolution, Mittal Publication, New Delhi, (2005).

Bhati .S. “Trust between Branch Managers and Loan Officers of Indian Banks”, Research Papers, (December 2006); PP: 51–58.

Muhammad Yunus., “The poor as the Engine of development Economic impact”, – Asian Journal of Finance and Accounting Vol. 2, (2010); PP: 27–31.

Joshi P. N., “Financing of Priority Sectors by Commercial Banks”, The journal of Indian institute of Bankers, (1972); PP: 27–34.

Angadi V. B., “Bank’s Advances to Priority Sectors”, – An Enquiry in to the Causes of Concentration, Economic and Political Weekly (March 26 1983); PP: 503–510.

The World Bank Report. “Sustaining India’s Service Revolution” (2004).

SNAKE CHARMERS AND THEIR CHALLENGES – A SOCIOLOGICAL STUDY

Ramya Nagesh* & Dr. K .kalachannegowda**

*Research student, Dept.of sociology, Manasagangotri, University of Mysore, Mysore

**Research Guide, Dept.of sociology, Maharaja’s college, University of Mysore, Mysore

Snake charming is the practice of pretending to hypnotize a snake by playing an instrument. A typical performance may also include handling the snakes or performing other seemingly dangerous acts, as well as other street performance staples like juggling and sleight of hand. The practice is most common in India though other Asian nations such as Pakistan, Bangladesh, Srilanka, Thailand and Malaysia are also home to performers, as are the North African countries of Egypt, Morocco and Tunisia.

Ancient Egypt was home to one form of snake charming though the practice as it exists today likely arose in India. It eventually spread throughout south East Asia, the middle east and North Africa despite a sort of golden age in the 20th century snake charming is today in danger of dying out. This is due to a variety of factors; chief among them was the enforcement of a 1972 law in India banning ownership of serpents. Animal rights groups have also made impact by decrying what they deem to be the abuse of a number of endangered species. Other factors are urbanization and deforestation. Which have made the snakes upon which the charmers rely became increasingly rare. This has in turn given rise to single most reason snake charming is declining.

Many snake charmers live a wandering existence, visiting towns and cities villages on market days and during festivals, with a few rare exceptions, however they typically make every effort to keep themselves from harm’s way more drastic means of protection include removing the creature’s fangs or venom glands, or even sewing the snake’s mouth shut. The most popular species

The desire to acquire knowledge about the surrounding world and human society is quite natural and understandable for a person. Life is so developed that an uneducated person will never occupy a high position in any field. Humanity in its mass, and each person individually, develops objectively, regardless of certain life circumstances and obstacles, but with different intensity. The speed of development depends on the quality of training.

The desire to acquire knowledge about the surrounding world and human society is quite natural and understandable for a person. Life is so developed that an uneducated person will never occupy a high position in any field. Humanity in its mass, and each person individually, develops objectively, regardless of certain life circumstances and obstacles, but with different intensity. The speed of development depends on the quality of training.

Comments (0)