How to Produce a Concert by Michael Burton Productions LLC (read more books TXT) 📖

- Author: Michael Burton Productions LLC

Book online «How to Produce a Concert by Michael Burton Productions LLC (read more books TXT) 📖». Author Michael Burton Productions LLC

What Is an Investor-Ready Business Plan?

Not all business plans are created equal. A plan for internal use will look drastically different from one you plan to submit to lenders. And one you will use to generate investor interest will be different still. If you will be sending your plan to potential investors, you need to tailor it to them. This is what is known as an "investor-ready" business plan.

An investor-ready business plan will tell venture capitalists and angel investors what they need to know to decide whether or not to invest in your company. To make your plan investor-ready, you will need to look at your plan through the eyes of the investors and address their concerns.

The investors, both VCs and Angels, are risking their hard-earned capital by investing in your venture in the hope of long-term returns worth many times their original investment. They will want to see a well-executed, investor-ready plan that demonstrates that you have a clear mission.

Here are some of the things your plan should address.

a. Management!

Investors invest in management — not ideas. Express your knowledge, passion, and dedication to your business as best as you can. The competence of your team, along with their experience levels and their commitment levels, are factors that investors look into before making their investment decisions.

b. Your product or Service.

Describe in detail the product or the services you will offer.

c. Customers!

Communicate to your potential investors that you understand the market for your Production.

Include a definitive description of your customers, market size, demographics, characteristics, growth prospects, trends, and sales potential per production City/State. You will also define your pricing strategies and describe how pricing will influence the growth potential of each Concert Production.

What Is An Angel Investor?

An Angel Investor or Angel (also known as a Business Angel or Informal Investor) is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity. A small but increasing number of angel investors organize themselves into angel groups or angel networks to share research and pool their investment capital.

Source and extent of funding Angels typically invest their own funds, unlike venture capitalists, who manage the pooled money of others in a professionally-managed fund. Although typically reflecting the investment judgment of an individual, the actual entity that provides the funding may be a trust, business, limited liability company, investment fund, etc.

The Harvard Report by William R. Kerr, Josh Lerner, and Antoinette Schoar tables evidence that angel-funded startup companies are less likely to fail than companies that rely on other forms of initial financing.

Angel Capital fills the gap in start-up financing between "friends and family" (sometimes humorously given the acronym FFF, which stands for "friends, family and fools") who provide seed funding, and venture capital. Although it is usually difficult to raise more than a few hundred thousand dollars from friends and family, most traditional venture capital funds are usually not able to consider investments under US$1–2 million. Thus, Angel Investment is a common second round of financing for high-growth start-ups, and accounts in total for almost as much money invested annually as all venture capital funds combined, but into more than ten times as many companies (US$26 billion vs. $30.69 billion in the US in 2007, into 57,000 companies vs. 3,918 companies).

Of the US companies that received Angel Funding in 2007, the average capital raised was about US$450,000. However, there is no “set amount” for angel investors, and the range can go anywhere from a few thousand, to a few million dollars. Software accounted for the largest share of angel investments, with 27 percent of total angel investments in 2007, followed by healthcare services, and medical devices and equipment (19 percent) and biotech (12 percent). The remaining investments were approximately equally weighted across high-tech sectors. Angel Financing, while more readily available than Venture Financing, is still extremely difficult to raise. However some new models are developing that are trying to make this easier. Many companies who receive Angel Funding are required to file a Form D with the Securities and Exchange Commission.

Investment profile Angel investments bear extremely high risk and are usually subject to dilution from future investment rounds. As such, they require a very high return on investment. Because a large percentage of angel investments are lost completely when early stage companies fail, professional angel investors seek investments that have the potential to return at least 10 or more times their original investment within 5 years, through a defined exit strategy, such as plans for an initial public offering or an acquisition. Current 'best practices' suggest that angels might do better setting their sights even higher, looking for companies that will have at least the potential to provide a 20x-30x return over a five- to seven-year holding period. After taking into account the need to cover failed investments and the multi-year holding time for even the successful ones, however, the actual effective internal rate of return for a typical successful portfolio of angel investments is, in reality, typically as 'low' as 20-30%. While the investor's need for high rates of return on any given investment can thus make angel financing an expensive source of funds, cheaper sources of capital, such as bank financing, are usually not available for most early-stage ventures, which may be too small or young to qualify for traditional loans.

Profile of Investor Community

The term "angel" originally comes from Broadway where it was used to describe wealthy individuals who provided money for theatrical productions. In 1978, William Wetzel, then a professor at the University of New Hampshire and founder of its Center for Venture Research, completed a pioneering study on how entrepreneurs raised seed capital in the USA, and he began using the term "angel" to describe the investors that supported them.

Angel investors are often retired entrepreneurs or executives, who may be interested in angel investing for reasons that go beyond pure monetary return. These include wanting to keep abreast of current developments in a particular business arena, mentoring another generation of entrepreneurs, and making use of their experience and networks on a less-than-full-time basis. Thus, in addition to funds, angel investors can often provide valuable management advice and important contacts. Because there are no public exchanges listing their securities, private companies meet angel investors in several ways, including referrals from the investors' trusted sources and other business contacts; at investor conferences and symposia; and at meetings organized by groups of angels where companies pitch directly to investor in face-to-face meetings.

According to the Center for Venture Research, there were 258,000 active angel investors in the U.S. in 2007. According to literature reviewed by the US Small Business Administration, the number of individuals in the US who made an angel investment between 2001 and 2003 is between 300,000 and 600,000. Beginning in the late 1980s, angels started to coalesce into informal groups with the goal of sharing deal flow and due diligence work, and pooling their funds to make larger investments. Angel groups are generally local organizations made up of 10 to 150 accredited investors interested in early-stage investing. In 1996 there were about 10 angel groups in the U.S.; as of 2008, while there are no official statistics, data from the company that provides deal management services for the majority of organized Angel investors indicates there are over 300, with a roughly equal number in all other countries combined; these groups accounted for approximately 12,000 individual angel investors in 2008. The more advanced of these groups have full time, professional staffs; associated investment funds; sophisticated web-based platforms for processing funding applications; and annual operating budgets of well over US$250,000.

The past few years, particularly in North America, have seen the emergence of networks of angel groups, through which companies that apply for funding to one group are then brought before other groups to raise additional capital. The development of the Angelsoft network, connecting a majority of existing angel groups, has led to an increase in the syndication of investments among more than one group.

ADDRESSING THE INVESTOR

Thank you for your Interest

My e-book will detail what we expect to be a very profitable year with regard to the show packages we present at this time.

Our primary goal is to show a profit for the investor. Thus our productions over the 2011 - 2012 season will be geared toward the socially aware 30 to 60 year olds.

Another primary focus, in any venue city will be to utilize all of our marketing campaigns effectively, i.e. Radio, TV (when necessary), record store autographs, personal appearances, contest, etc.

I have worked to deliver some of the top R&B grossing shows in the Country over the past 40 years.

With my vast knowledge of pre & post productions, which of course includes logistics, I've worked hard to be the best that I can possibly be.

SHOWS THROUGHOUT 2011

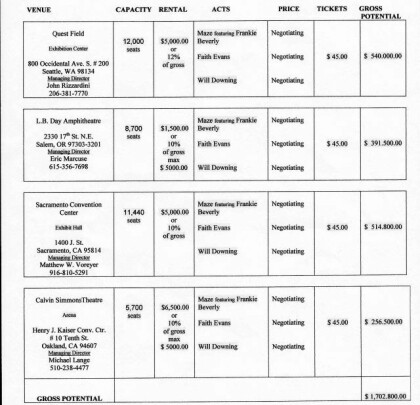

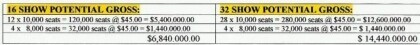

Concerts start Valentine Day 2011 and run through September. We plan to average 2 - 4 shows per month, that's 16 shows doing two shows per month, or 32 shows doing four shows per month.

The frame below shows that of the 16 arenas only twelve have 10,000 seats, and of the 32 arenas only 28 have 10,000 or more.

As you can see, any potential estimate generates very good figures. As stated above, our primary goal is to show a profit for any investor. This is with a buy-in of only $80,000.00 in which we roll over the gross proceeds. Remember that description 'roll over'.

Here is where I will address the four-day Labor Day event. Our success is only as good as we make it. As you read on you will see that with preparations the gross cash potential is only limited by the work we agree to put into it, (television, percentage of CD sales, percentage of pay-per view, sales of t-shirts, caps, jerseys, all food items, sponsorships from major players such as airlines, bus services, video services, contest, our own 900 number, the list is as large as we make it).

The cost of preparing the Labor Day production comes from taking $ 30,000.00 from every concert we promote thru August of any given year.

One-year projections at best have been described here. We can continue for the unforeseeable future to provide quality shows around the Country.

As you read creating the show, it outlines how multiple artists are added and how the structure is put together for the show. How I described the buy-in to you by investing $80,000.00, would cut a three-act show investment of $150,000.00 in half, and increase the estimated gross potential. Having an opening act of local talent, or a named comedian does this. Although this depends on the City, we will provide what the City demands for a sold out show, allowing a possible second show to be added.

As you can see, any potential estimate generates very good figures. As stated above, our primary goal is to show a profit. With a buy-in of only $80,000.00 to $100,000.00, there is no limit to the number of shows we can promote. My contacts are of this caliber throughout the Industry. I can in most cases bypass Management Agencies also.

"Let's Take It To The Stage"

What Is Networking?

and "Why" is it so important to Michael Burton Productions?

Networking is the practice of gathering of contacts: the process or

Comments (0)